Cash-out experience of PicPay

PicPay was one of the largest payment app in Brazil

+30M users

+3M places accepting it in Brazil

$380M in transactions monthly - in the cash out journey

I joined Cash Out Squad as a Product Designer when the app partnered with the Brazilian government to provide emergency aid for low-income people during COVID. This led to a surge in users and withdrawals, exposing many flaws in the cash out flow. I prioritized the most urgent and impactful design projects and collaborated with project manager, developers and stakeholders.

This is a brief summary of how I tackled the challenges.

[Dynamic page data - Case study intro text]

Product Designer

PicPay

2020

iOS & Android

The problem

The app faced a sudden growth due to a government subsidy that provided emergency aid for low-income people during COVID.

This resulted in:

🚫A large number of users who could not withdraw or transfer money due to technical and user experience issues

📈 Around +USD $380K more withdrawals within 3 months

😕 Increased support tickets

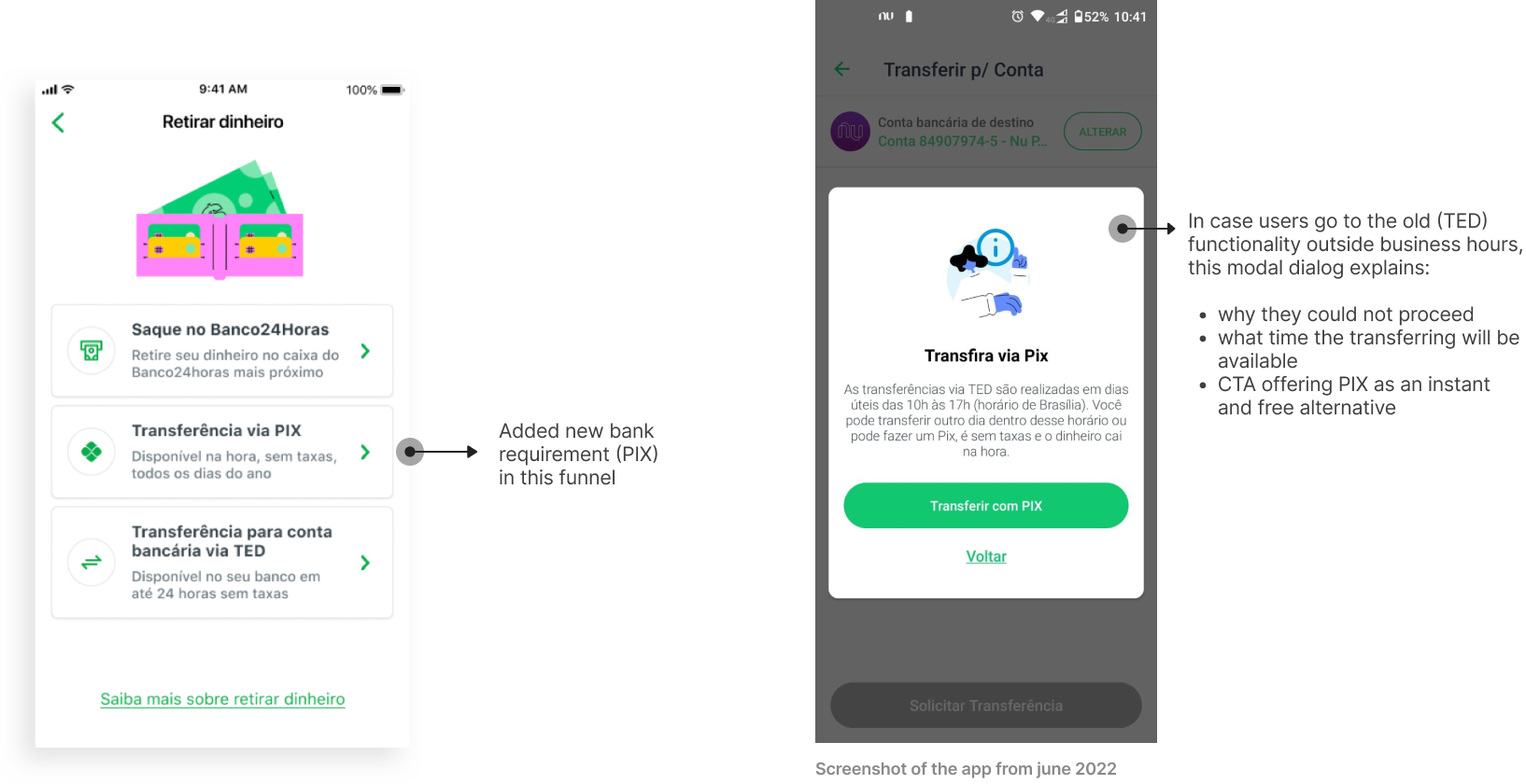

🏦 New bank requirement (PIX) that confused users and limited their options

The goal

Tackle the major pain points to decrease tickets and improve UX

💬 Add specific and helpful error messages

🏦 Add new bank requirement to the cash-out journey

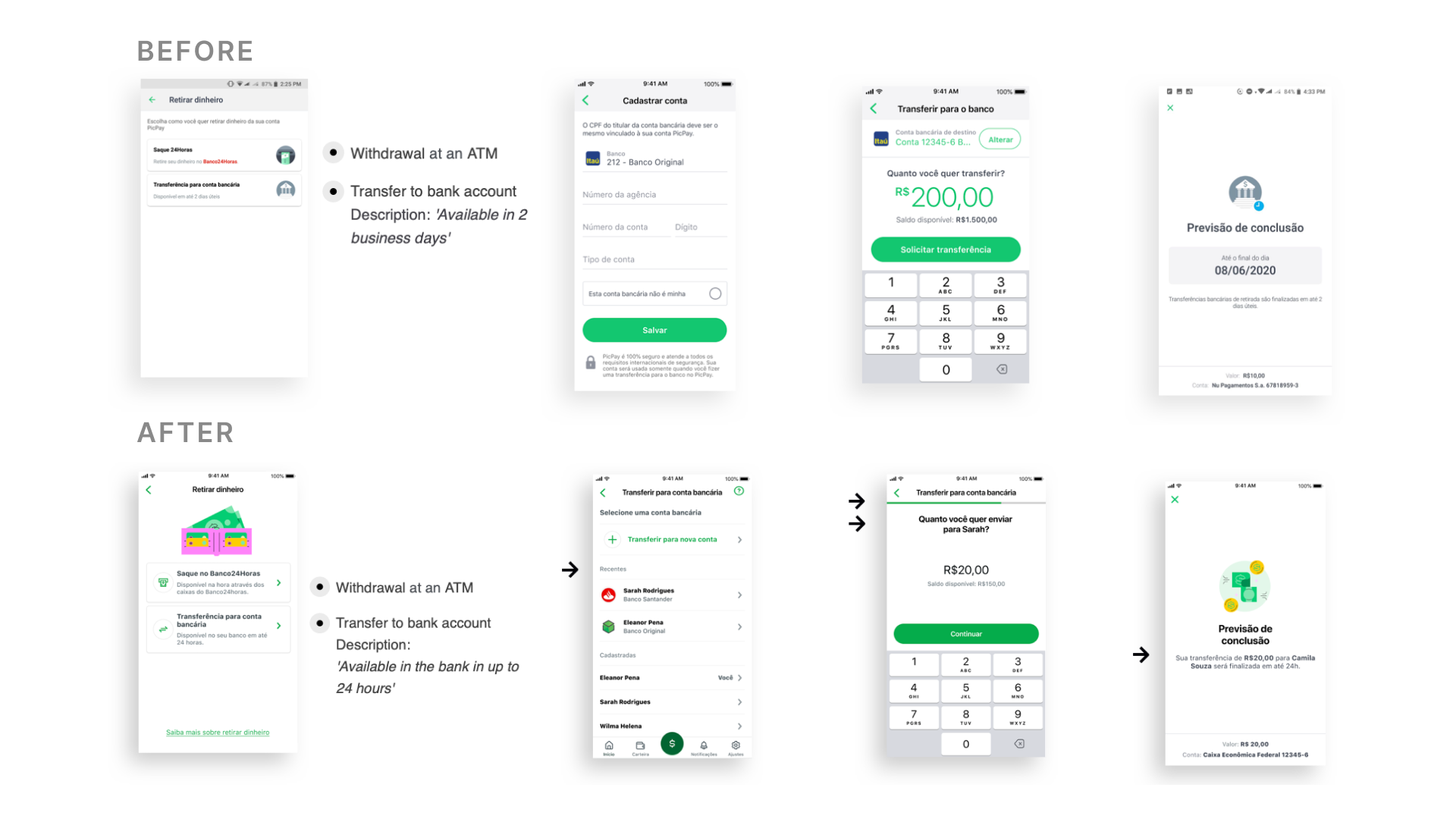

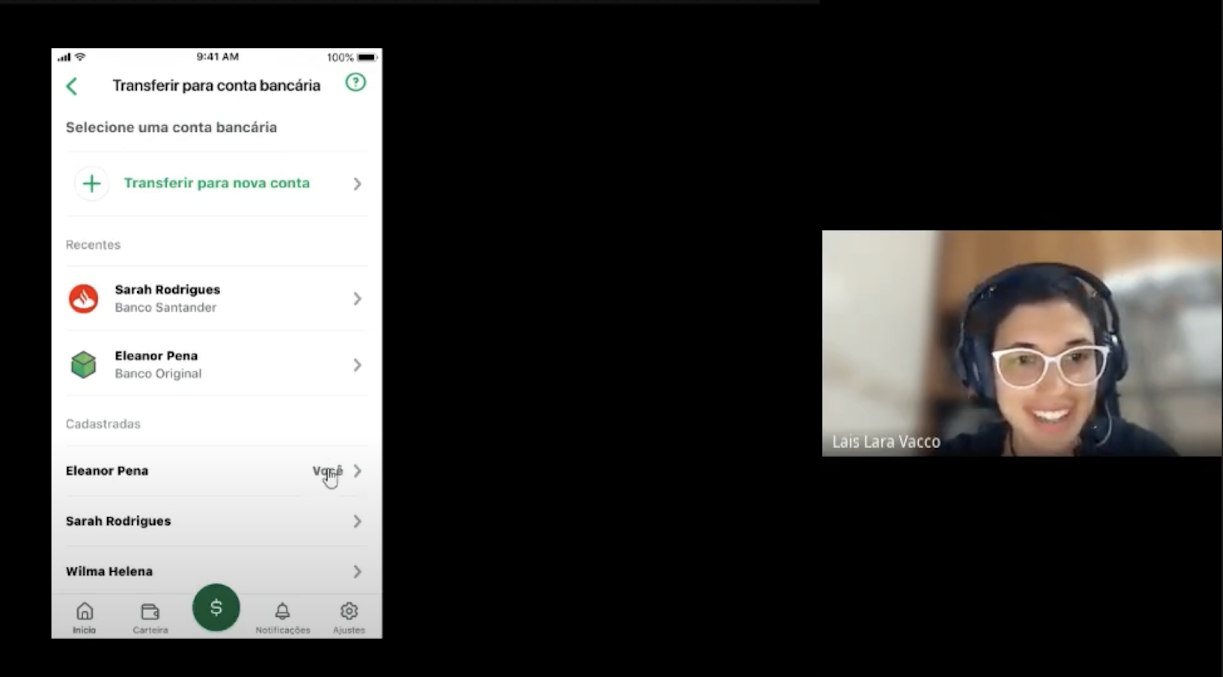

🎯 Create a new cash-out journey when transferring to another bank

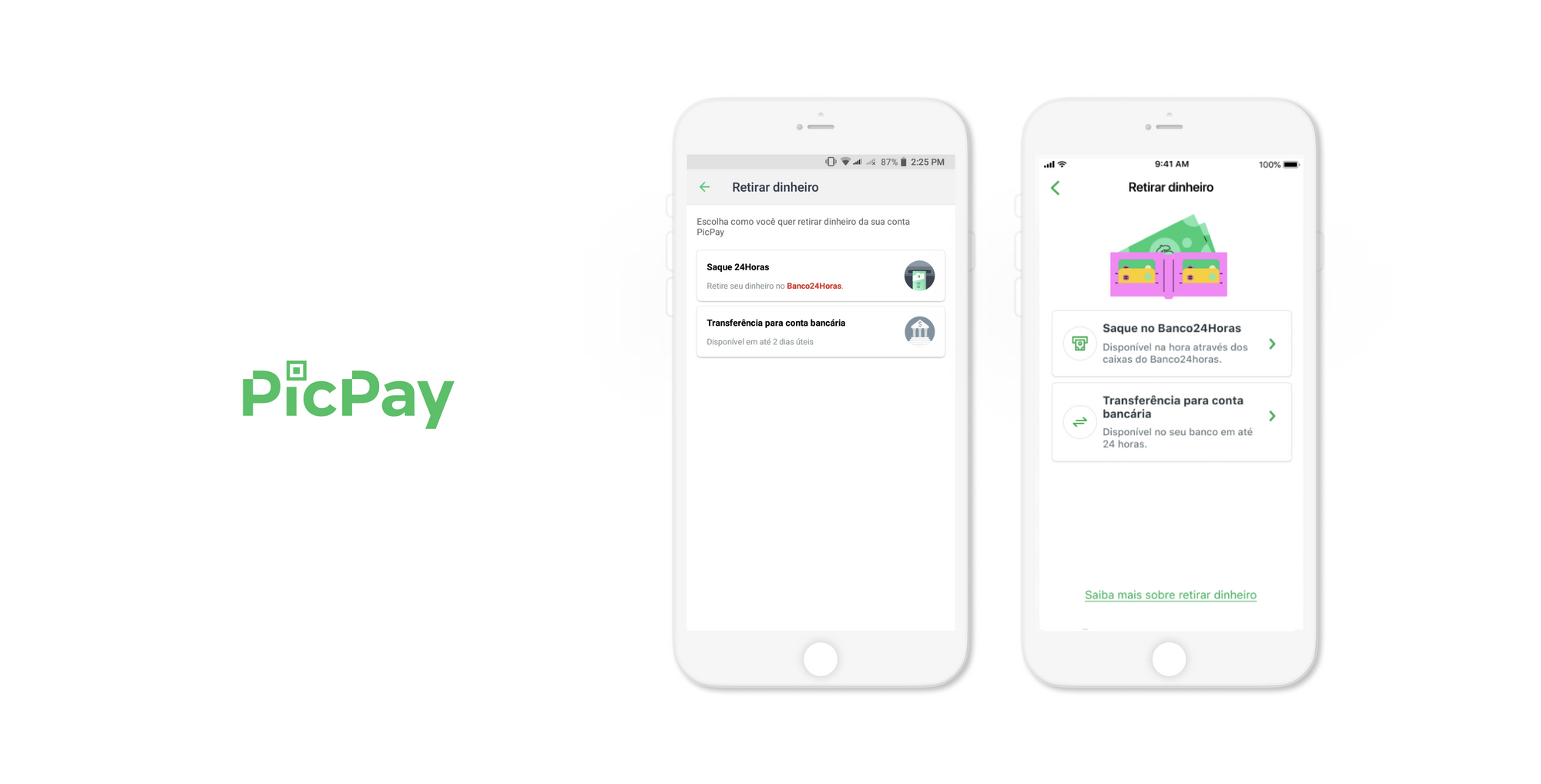

📱 Add new UI to create a consistent experience across the wallet

RESEARCH

I collected data from:

Existing research

Customer Experience team

Mixpanel

Survey with heavy users

DEFINE

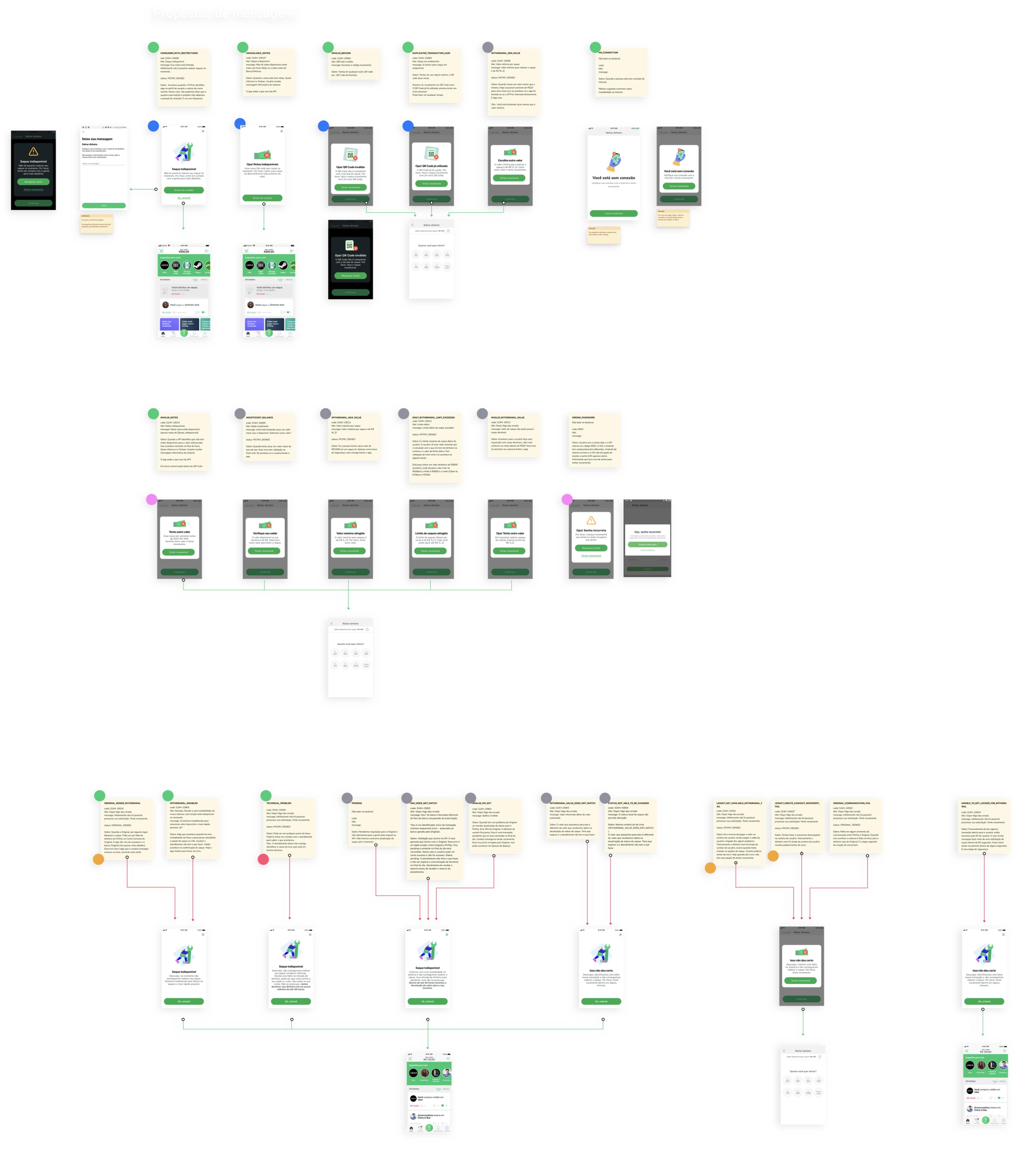

I did a service blueprint to visualize each step of the user journey and mapped the opportunities.

Then, I prioritized them based on their urgency and impact.

DESIGN EXPLORATION

I found that the system had +20 technical errors, but the app only had 5 error messages.

My task was to create +20 user-friendly error messages, working closely with the developers.

I also explored some solutions for the pain points in the cash out flow of transferring to another bank account.

I validated these solutions with users later.

VALIDATION INSIGHTS

The validation revealed that users:

Were confused with the new bank requirement

Wanted to print their receipt

ITERATION

Based on the validation, I discovered an opportunity that was not previously mapped.

Users expected to find the new bank requirement in that funnel, but it was not available due to some limitations.

We could still suggest it as an alternative.

So, if users tried to use that functionality outside business hours, they would see a modal dialog that explained:

Why they could not proceed

What time the transfer would be available

A CTA offering the new bank function (PIX) as an instant and free alternative

This solution was prioritized over all other solutions, as it had a high impact given the context of the new bank requirement.

REFLECTION

🚧 Implement in small releases

✅ Validate early with users

🤝 Collaborate often with developers

Let's get in touch

Feel free to reach out for collaborations or just a friendly hello 😄

llaravacco@gmail.comDesigned and built by Lais Lara Vacco in 2022 using Ycode.

Last updated Jan 2025.