-1aagki7jlt.webp)

Cash-out experience of PicPay

Led redesign of cash-out flow and feedback messages to improve the experience during government subsidy for financial app.

Project Timeframe

1 monthTeam size

10 membersPlatform

iOS & Android AppProduct

Digital Wallet- FintechBusiness

Legal TechMain Outcome

2x increase in caseProject Timeframe

4 monthsWhether you're saving for a home, college, or a vacation, we help you monitor your progress and reach your goals faster.

Receive real-time alerts, detailed reports, projected cash flows, and more to make more informed and strategic decisions.

Receive real-time alerts, detailed reports, projected cash flows, and more to make more informed and strategic decisions.

Our clients trust us to elevate their brand.

Experience that drives measurable results.

Building lasting partnerships based on trust and results.

PicPay is one of the largest payment apps in Brazil that offers a diverse range of financial services through its mobile app.

Rapid growth environment

I joined PicPay's Cash Out squad as a Product Designer during a period of rapid growth, fueled by the company's partnership with the Brazilian government to distribute emergency aid during the COVID-19 pandemic.

This influx of new users exposed significant usability issues in the cash-out flow.

My role was to identify and address these issues, focusing on the most urgent and impactful improvements.

Leading the design of key mobile app features for iOS, focusing on enhancing user experience through intuitive navigation and a clean, cohesive design language.

Leading the design of key mobile app features for iOS, focusing on enhancing user experience through intuitive navigation and a clean, cohesive design language.

Leading the design of key mobile app features for iOS, focusing on enhancing user experience through intuitive navigation and a clean, cohesive design language.

My role

Problem & Challenges

Goals

How might we offer takes as a small experiment?

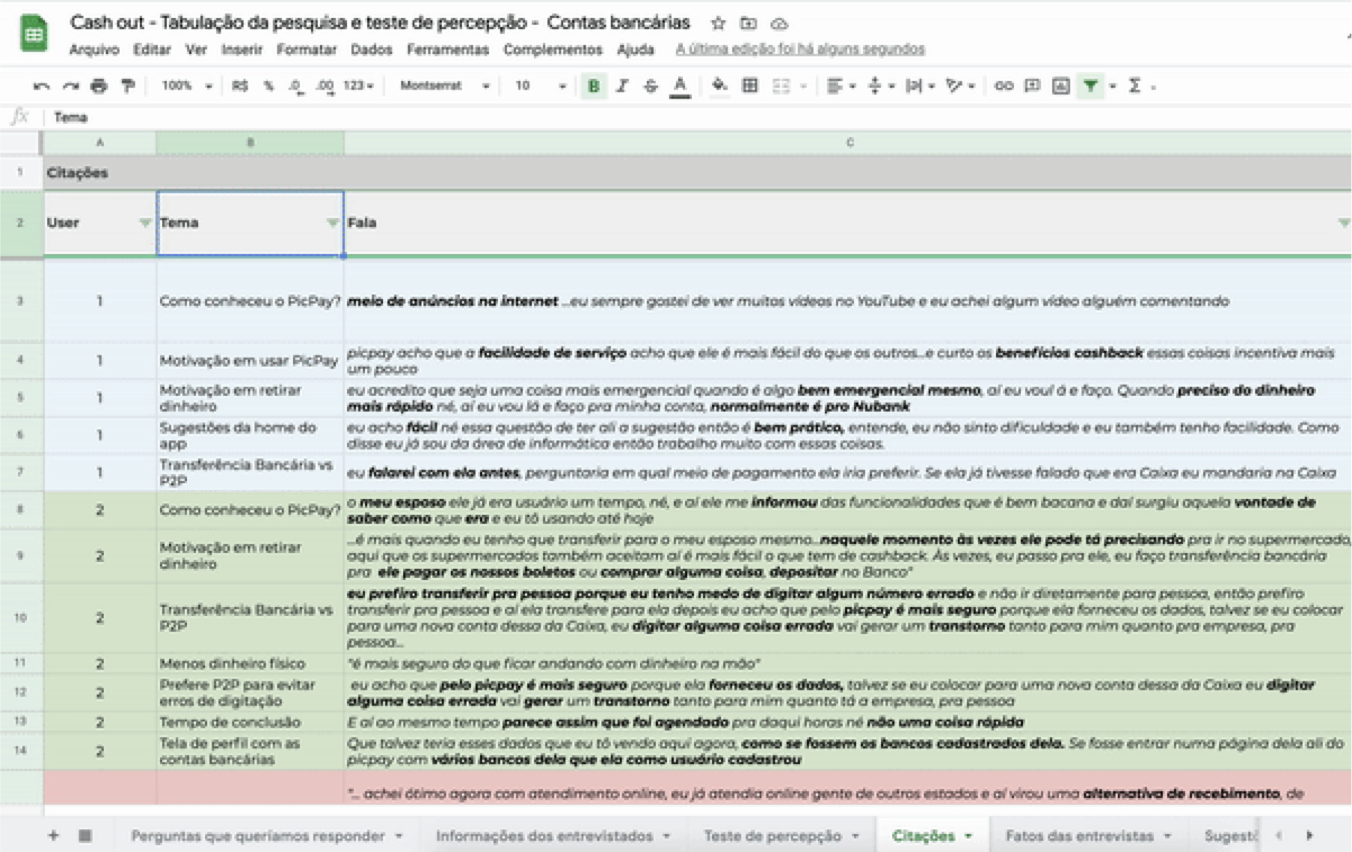

To understand the challenges users faced, I gathered data from various sources:

- Existing Research: Reviewed previous user research and usability studies.

- Customer Experience Team: Gathered insights from the support team.

- Mixpanel: Analyzed user behavior data to identify pain points.

- User Surveys: Conducted surveys with frequent users to gather feedback.

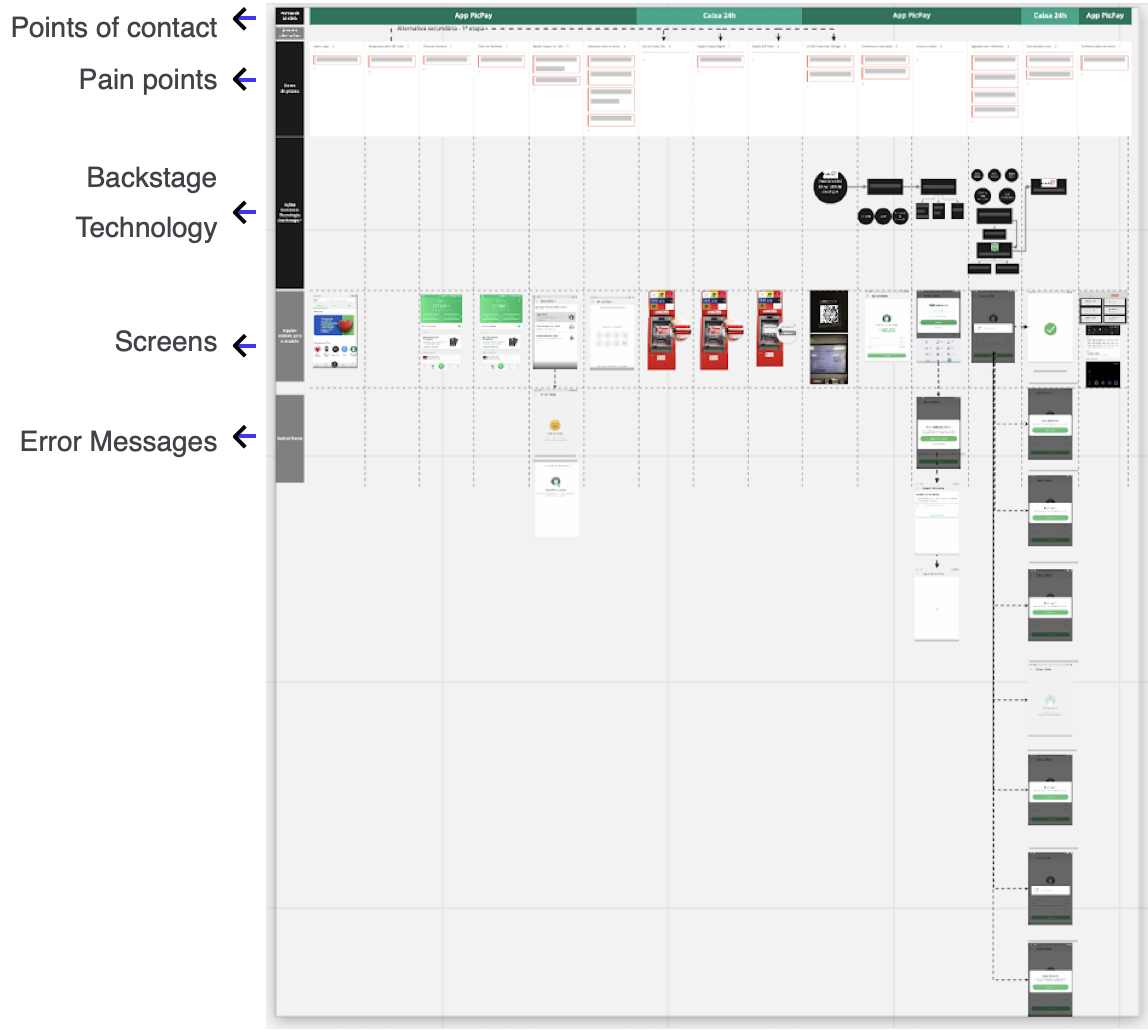

To make sense of the complexity, I created a service blueprint mapping every step of the journey.

This helped me visualize where users dropped off, where the system failed, and how both front stage and backstage processes connected.

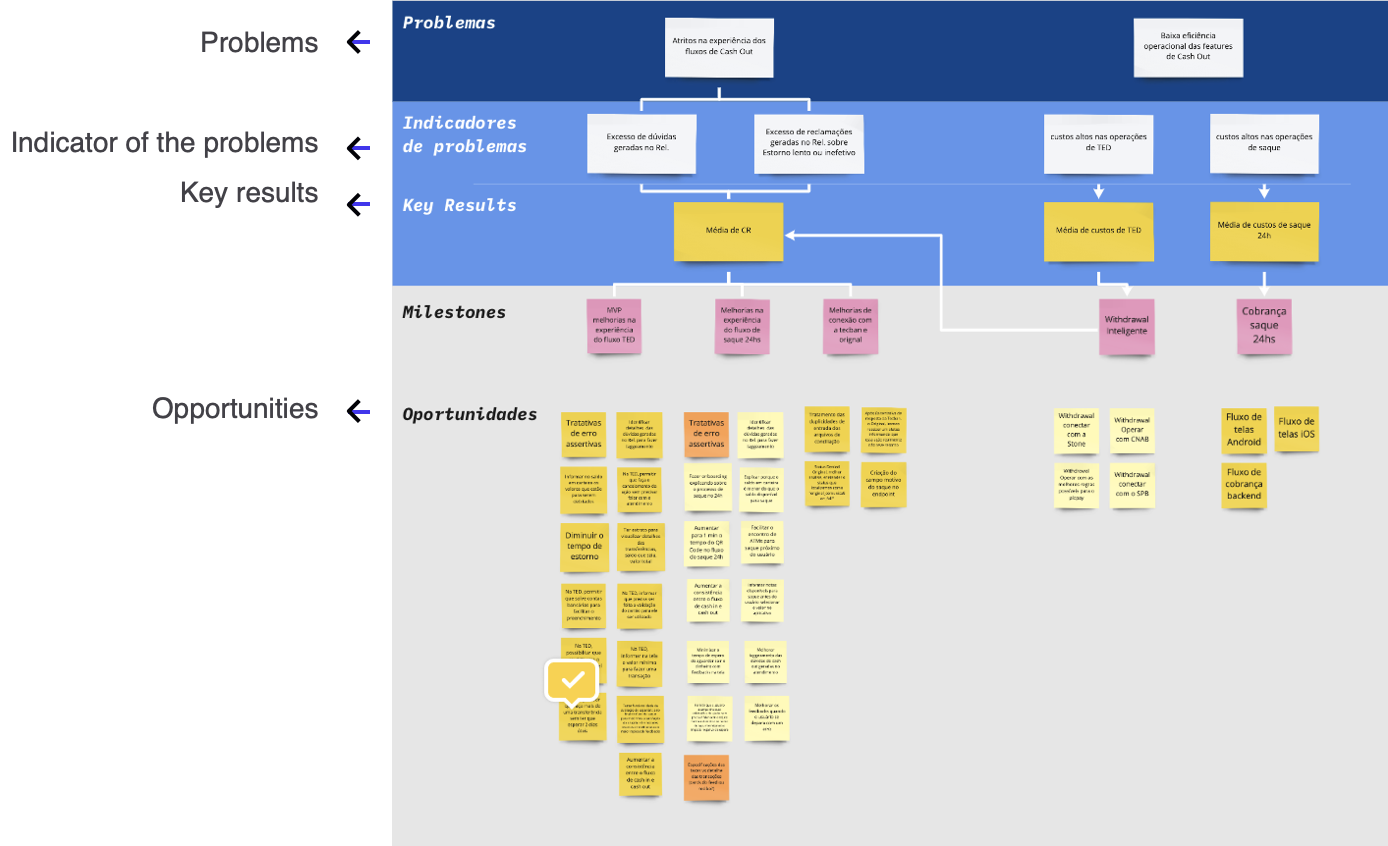

With the blueprint in hand, I worked with stakeholders to prioritize opportunities by urgency and impact, focusing first on the issues that blocked people from withdrawing money.

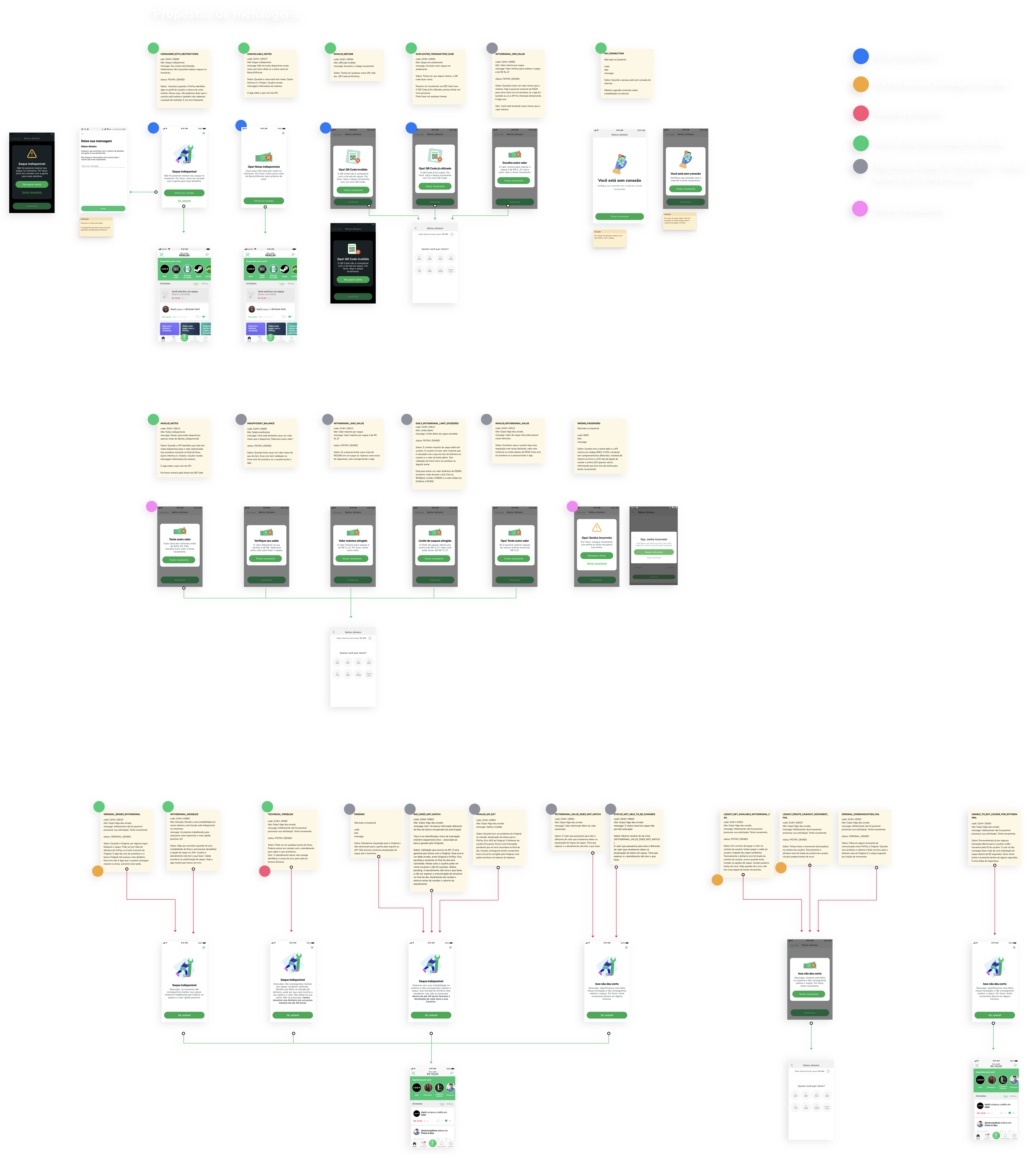

Improving error messages

One critical gap was error handling.

While the system had over 20 possible technical errors, the app showed only 5 generic messages.

I rewrote and expanded these into clear, actionable feedback messages so users always knew what went wrong and what to do next.

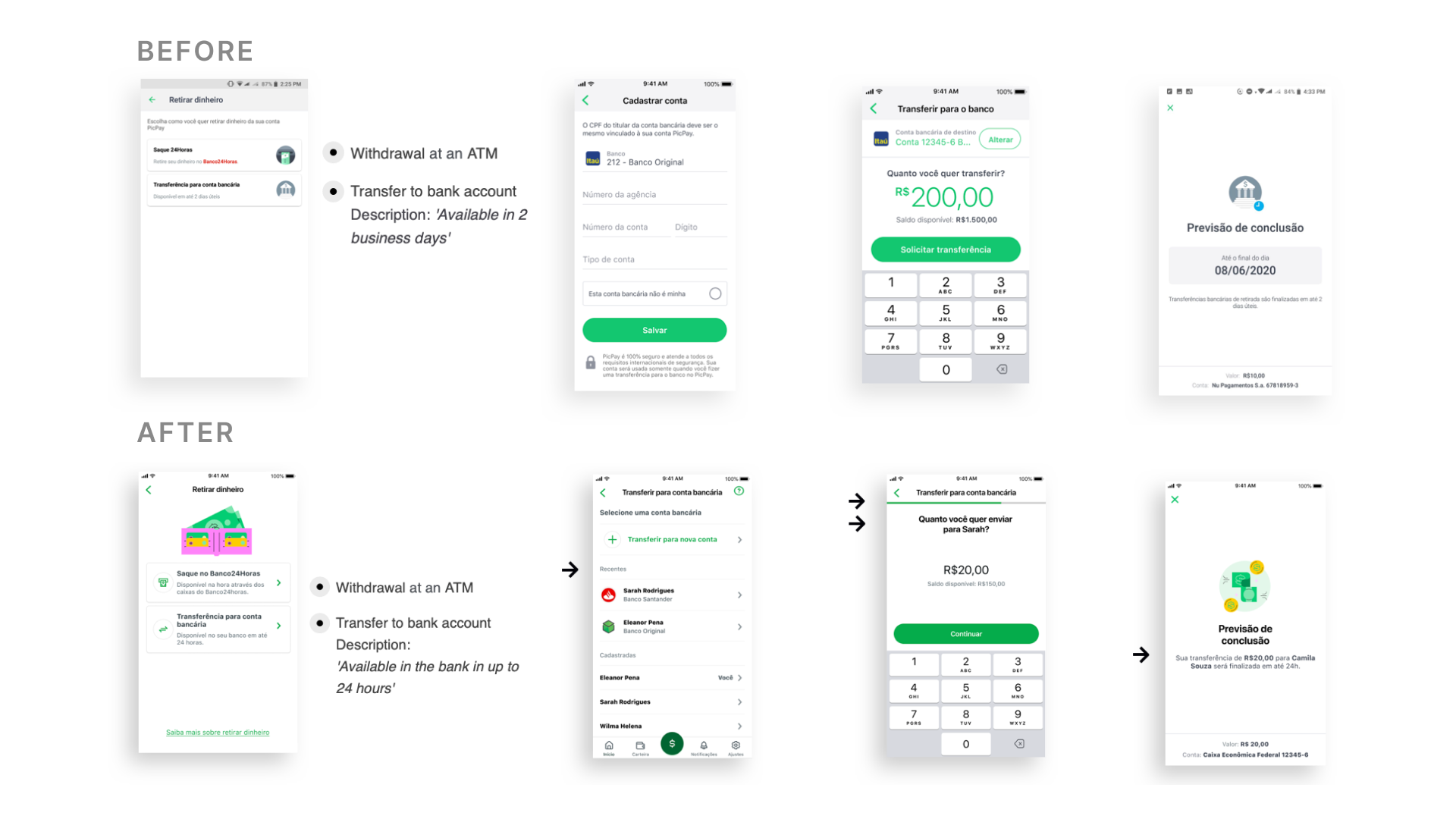

Enhancing the Bank Transfer Flow

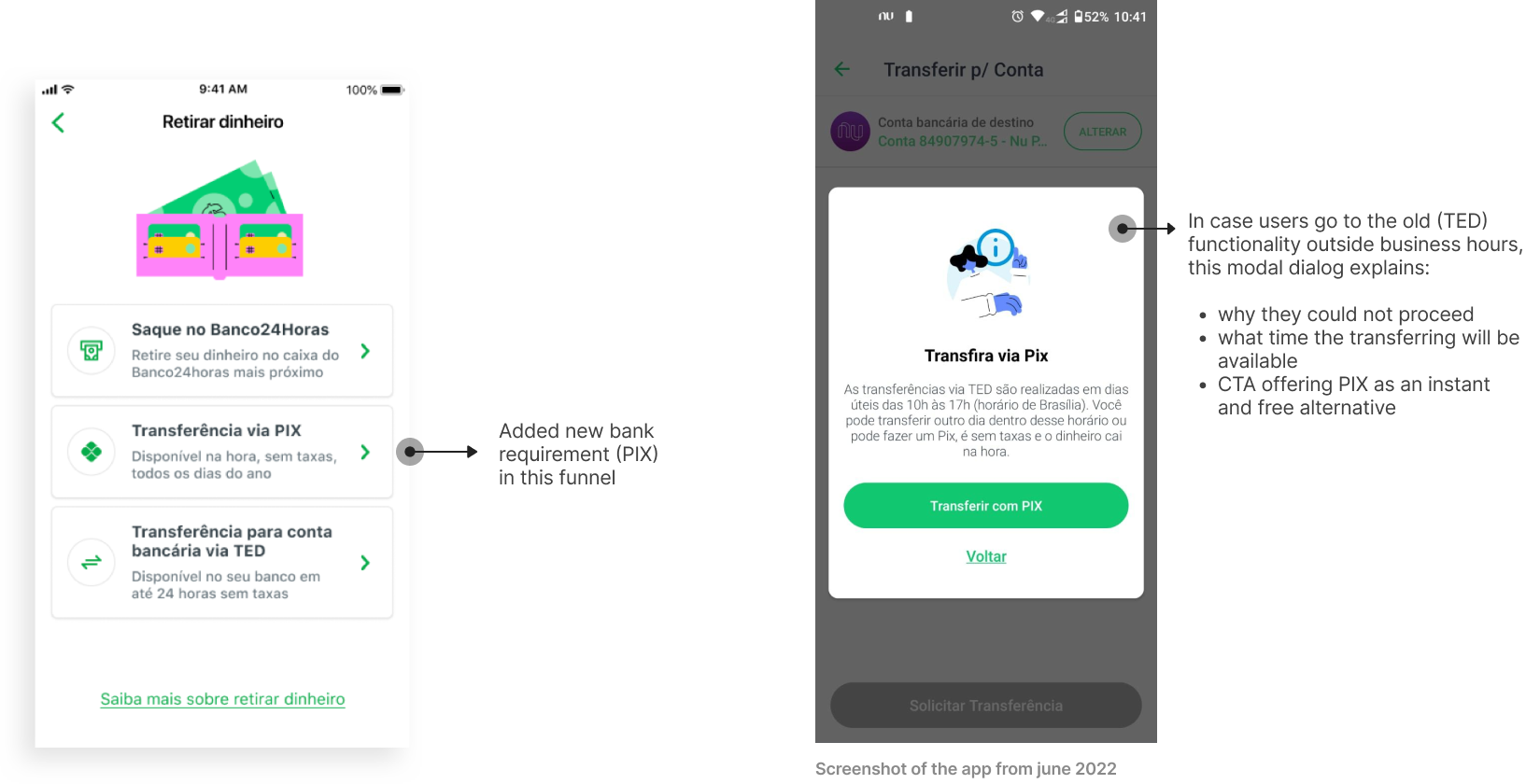

At the same time, I redesigned parts of the cash-out flow to accommodate new banking rules.

This meant creating a separate journey for bank transfers and updating the wallet UI for a more consistent, trustworthy experience.

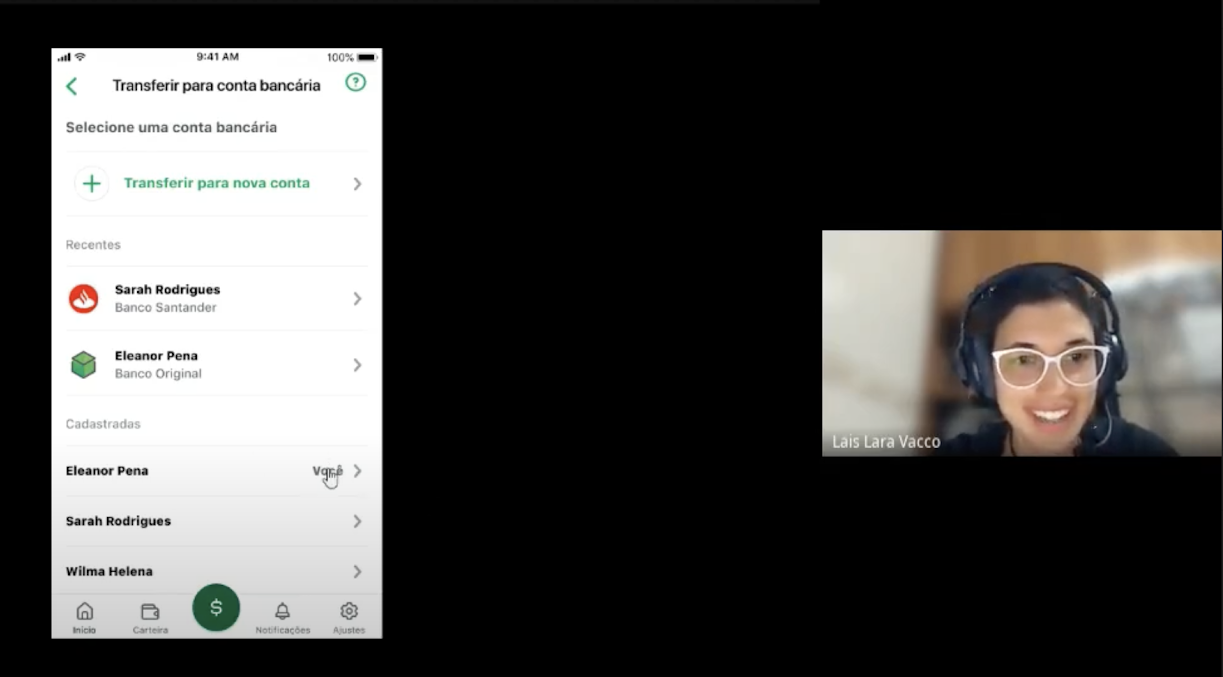

Validation & Iteration

Usability testing revealed two key insights:

1. Users were confused by the new PIX requirement.

2. Many wanted proof of transaction, such as printable receipts.

Based on this, I introduced contextual modals that explained downtime, set expectations for when transfers would be available, and suggested PIX as a faster, free alternative.

This small change addressed regulation, reduced confusion, and gave users more control.

Impact

The project followed a phased release approach; I transitioned from PicPay before later phases were completed.

Continuous Improvement

Home

Let’s connect.

Feel free to reach out for collaborations or just a friendly hello.

Crafted with care by Lais Lara Vacco using Ycode 🌿

Updated Jan 2026